Private Equity Firms Eye Potential Takeover of Vivid Seats Amid Live Entertainment Boom

Vivid Seats, a major ticketing platform, is attracting significant private equity takeover interest, potentially setting up for a sale in 2025. The company, which went public through a SPAC merger in 2021, has seen its stock price rise 36% in the past month to around $4.60 per share, though still down 28% year-over-year.

People throwing money at concert crowd

The company's Q3 2024 financial results showed:

- Total revenue: $186.61 million (slight YoY decrease)

- Concert ticket marketplace revenue: $67.70 million (22% YoY decrease)

- Theater ticket revenue: $28.71 million (nearly doubled)

Notable investor movements include:

- Barclays increased holdings by 350% to 125,163 shares in Q3 2024

- Geode Capital Management expanded position by 18.9% to 1.98 million shares

This potential sale reflects broader industry trends in the live entertainment and ticketing sector:

- Seat Unique raised $19.1 million in an extended Series A

- TickPick secured a $250 million growth investment

- StubHub explored a $16.5 billion IPO

- Dice considered a sale valuing it in hundreds of millions

- CTS Eventim posted record nine-month revenue after acquiring See Tickets

The timing is notable as it coincides with both continued investor enthusiasm in the live entertainment sector and signs of a possible market slowdown. Despite Ticketmaster's dominant position, investors remain eager to capture market share in the growing live entertainment ticketing space.

Neon Boiler Room sign

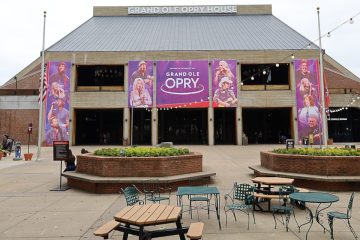

Opry House exterior at night