Spotify Stock Soars 115% in 12 Months - Can SPOT Maintain Its Record Growth in 2024?

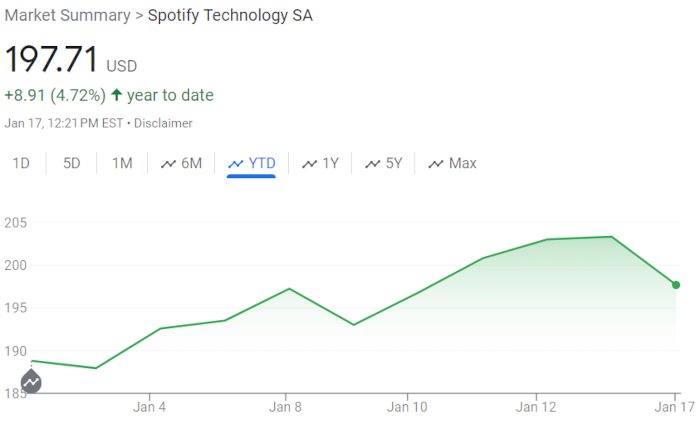

Spotify stock (NYSE: SPOT) has demonstrated remarkable momentum, showing a 115% increase over the past 12 months and maintaining strong performance into 2024 with a 5% year-to-date growth. The stock currently trades at $197.71, outperforming its peer average by 1112.3%.

Spotify stock price line chart

Key Performance Indicators:

- Market cap: Over $38.5 billion

- 52-week high: $204.03

- Trading volume: 30% above 20-day average

- Analyst projections: 5% growth expected for 2024

Recent Strategic Changes:

- Major workforce reduction (20% of staff laid off)

- Shift toward profitability-focused operations

- Moving away from acquisition-heavy strategy

Critical Factors Affecting Future Performance:

- Profitability sustainability

- Joe Rogan Experience podcast deal renewal (previous deal: $200 million)

- Ongoing search for permanent CFO

The company's transformation from growth-at-all-costs to profitability-focused operations marks a significant shift in strategy. CEO Daniel Ek has committed to maintaining consistent profitability, though upcoming layoff-related expenses may temporarily impact financial results.

The Joe Rogan Experience remains crucial to Spotify's podcast strategy, with its diverse guest list including Elon Musk, Post Malone, Sam Altman, and Ice Cube contributing to the platform's popularity.

Investors should watch for Spotify's Q4 2023 financial results, scheduled for February 6th, which will provide more insight into the company's profitability initiatives and future growth potential.

Live Nation logo with concert audience

Related Articles

Netflix Price Hike Follows Strong Q4 2023: Will Music Streaming Giants Follow?