What Is Hipgnosis Songs Fund, Anyway? The Answer Is Really, Really Complicated

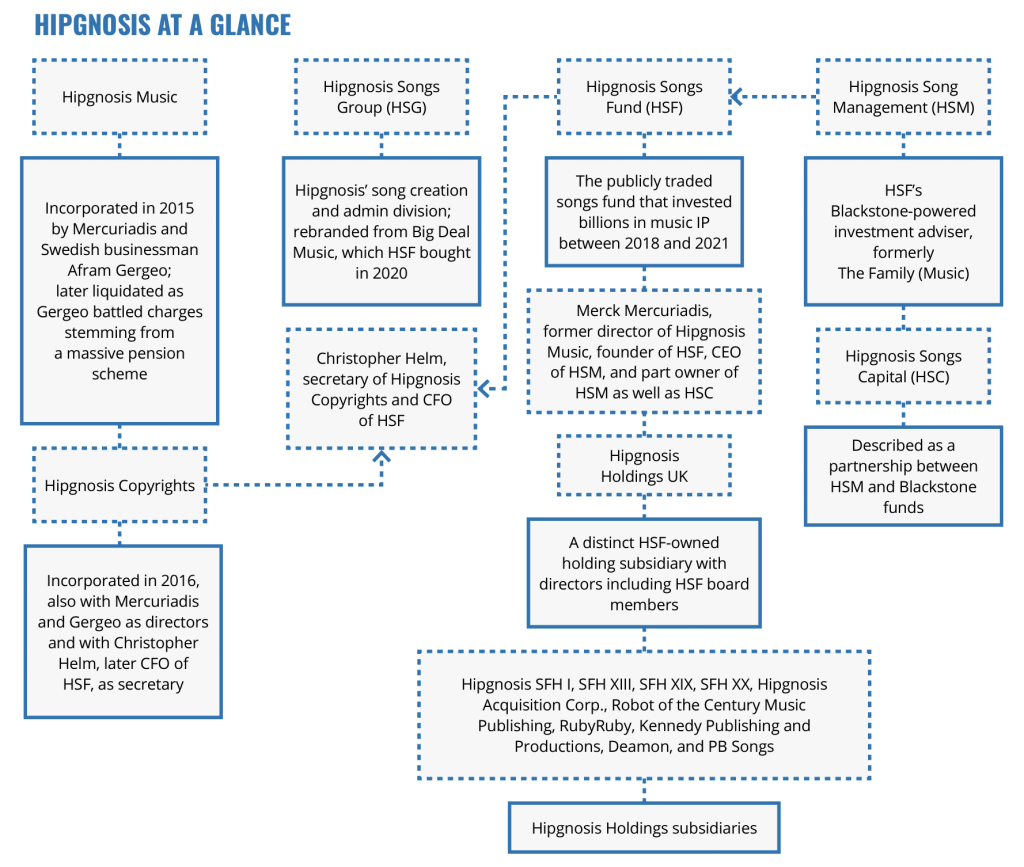

Hipgnosis Songs Fund is a complex web of music investment entities that has recently faced significant challenges and scrutiny. Here's a clear breakdown of the main components and recent developments:

Hipgnosis Music Fund ownership structure

Key Entities:

- Hipgnosis Songs Fund (HSF): The primary UK-listed investment company focused on music IP acquisitions

- Hipgnosis Songs Management (HSM): Advisory firm led by Merck Mercuriadis that oversees catalog management

- Hipgnosis Songs Capital (HSC): Private fund backed by The Blackstone Group and overseen by HSM

Recent Developments:

- Failed Catalog Sale (September 2023):

- Proposed $440 million sale of 29 catalogs from HSF to HSC

- Rejected by shareholders due to conflicts of interest between entities

- Legal Battle (November 2023):

- Lawsuit between Hipgnosis Songs Fund and defunct Hipgnosis Music Limited

- HML owed $4.54 million to creditors at time of collapse

- Raises questions about company's past operations

Organizational Structure:

- Approximately dozen different entities with "Hipgnosis" in their names

- Additional entities include Hipgnosis Songs Group, Hipgnosis Holdings UK, and multiple Holdings subsidiaries

- All entities connected to founder/co-founder Merck Mercuriadis

- Complex web of overlapping roles, executives, and ownership structures

The intricate organizational structure and recent controversies have raised concerns among investors and industry observers about the company's transparency and long-term stability. The rejected catalog sale and ongoing legal disputes have particularly damaged investor confidence in what was once considered a promising music industry investment vehicle.

Ramones on stage in concert

Concert crowd inside O2 Arena

Related Articles

Netflix Price Hike Follows Strong Q4 2023: Will Music Streaming Giants Follow?