HYBE Chairman Bang Si-hyuk Under Investigation for 400 Billion Won IPO Deals

HYBE CEO Bang Si-hyuk is facing scrutiny over alleged undisclosed profits of 400 billion won from private agreements made with equity firms during the company's 2020 IPO.

The agreements involved STIC Investments, which acquired 3.46 million Hybe shares in 2018, along with Eastone Equity Partners and Neumain Equity. These deals included a 30% profit-sharing clause contingent on a successful IPO, information that wasn't disclosed during the listing process.

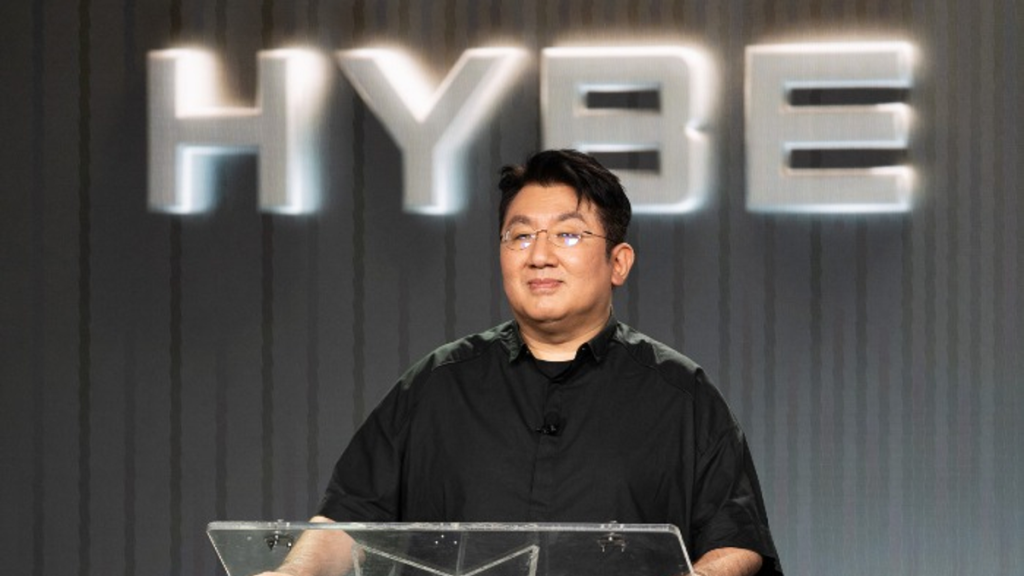

Bang Si-hyuk speaking at podium

A securities firm representative defended the non-disclosure, stating: "Legal reviews concluded that it was a private agreement between shareholders and did not need to be disclosed." They noted that the possibility of PEF share sales was mentioned in the securities report.

The private equity funds maintain their share sales didn't significantly impact stock prices. While STIC's sales represented only 1.7% of the 11.17 million shares traded on opening day, Hybe's stock initially surged 150% before dropping 60% within a week.

Industry insiders explain that the agreements were made anticipating BTS's military service, with PEFs requesting put options as security. Bang reportedly chose to handle these options through personal shares to protect the company.

The controversy has intensified following recent developments, including NewJeans' announced departure from Hybe's Ador after former head Min Hee-jin's exit. The situation continues to raise questions about transparency in high-profile IPO processes.

Elton John wearing tinted medical glasses

Coachella crowd at night